In this post, I want to focus on a very interesting paper published by Y. Louzoun et. al. in 2003 (Artificial Life vol. 9 n. 4 - MIT Press). Their paper shows that world-size global market lead to economic instability. The model is based on an extended Lokta-Voltera equation applied on a two-dimensional lattice with two main parameters: R is the range over which competition between agents can take place, and D is a diffusion coefficient of wealth. They argue that extreme values for globalization R and redistribution D, as advocated respectively by extreme capitalism and extreme socialism, are equally counterproductive and possibly disastrous due to catastrophic fluctuations. However, there is a regional globalization scale that seems to optimize the system. They conclude that moderate-size regional markets (R ~ system size / 10) partially protected from external competition, are the optimal economic configuration. Well, I would like to have enough time to be able to work on that subject. Interesting, no ? (Earth image from space - Courtesy Nasa).

In this post, I want to focus on a very interesting paper published by Y. Louzoun et. al. in 2003 (Artificial Life vol. 9 n. 4 - MIT Press). Their paper shows that world-size global market lead to economic instability. The model is based on an extended Lokta-Voltera equation applied on a two-dimensional lattice with two main parameters: R is the range over which competition between agents can take place, and D is a diffusion coefficient of wealth. They argue that extreme values for globalization R and redistribution D, as advocated respectively by extreme capitalism and extreme socialism, are equally counterproductive and possibly disastrous due to catastrophic fluctuations. However, there is a regional globalization scale that seems to optimize the system. They conclude that moderate-size regional markets (R ~ system size / 10) partially protected from external competition, are the optimal economic configuration. Well, I would like to have enough time to be able to work on that subject. Interesting, no ? (Earth image from space - Courtesy Nasa).Sunday, March 26, 2006

Eonomic Instability

In this post, I want to focus on a very interesting paper published by Y. Louzoun et. al. in 2003 (Artificial Life vol. 9 n. 4 - MIT Press). Their paper shows that world-size global market lead to economic instability. The model is based on an extended Lokta-Voltera equation applied on a two-dimensional lattice with two main parameters: R is the range over which competition between agents can take place, and D is a diffusion coefficient of wealth. They argue that extreme values for globalization R and redistribution D, as advocated respectively by extreme capitalism and extreme socialism, are equally counterproductive and possibly disastrous due to catastrophic fluctuations. However, there is a regional globalization scale that seems to optimize the system. They conclude that moderate-size regional markets (R ~ system size / 10) partially protected from external competition, are the optimal economic configuration. Well, I would like to have enough time to be able to work on that subject. Interesting, no ? (Earth image from space - Courtesy Nasa).

In this post, I want to focus on a very interesting paper published by Y. Louzoun et. al. in 2003 (Artificial Life vol. 9 n. 4 - MIT Press). Their paper shows that world-size global market lead to economic instability. The model is based on an extended Lokta-Voltera equation applied on a two-dimensional lattice with two main parameters: R is the range over which competition between agents can take place, and D is a diffusion coefficient of wealth. They argue that extreme values for globalization R and redistribution D, as advocated respectively by extreme capitalism and extreme socialism, are equally counterproductive and possibly disastrous due to catastrophic fluctuations. However, there is a regional globalization scale that seems to optimize the system. They conclude that moderate-size regional markets (R ~ system size / 10) partially protected from external competition, are the optimal economic configuration. Well, I would like to have enough time to be able to work on that subject. Interesting, no ? (Earth image from space - Courtesy Nasa).Monday, March 13, 2006

Al-Jazari Automata

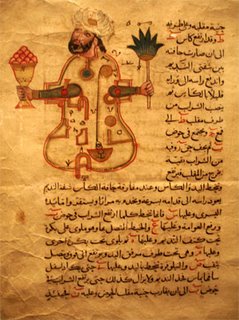

Yesterday, I have visited the "The Golden Age of Arabic Sciences" exhibition at the Arabic World Institute in Paris. Among a very good selection of many scientific discoveries of this civilisation, it was an opportunity to see some documents written by Al-Jazari. Ibn Ismail Ibn al-Razzaz Al-Jazari (1206 AD) was one of history's greatest engineers. He invented many automata and some of the first mechanical clocks, driven by water and weights. He was called Al-Jazari after the area where he was born, Al-Jazira, which is the traditional Arabic name for northern Mesopotamia. Al-Jazari draws on the works of its predecessors both from the Greeks (Philon, Heron and Archimede) and Islamic world (Banu Musa brothers, Al-Khuwarizmi and Ridwan). His contribution was very important for the diffusion of knowledge in the Arabic world and after in Europe due to the translations of his books like "The Book of Knowledge of Ingenious Mechanical Devices" which contains more than 150 automata and mechanical devices. I take the picture in the museum showing a page of "A Compendium on the Theory and Practice of the Mechanical Arts" dated 1315-1316 (AD). The picture shows the internal structure of an automata for serving and arbitrating drinking sessions. That is to say that Al-jazira has an important place in the history of artificial creatures.

Yesterday, I have visited the "The Golden Age of Arabic Sciences" exhibition at the Arabic World Institute in Paris. Among a very good selection of many scientific discoveries of this civilisation, it was an opportunity to see some documents written by Al-Jazari. Ibn Ismail Ibn al-Razzaz Al-Jazari (1206 AD) was one of history's greatest engineers. He invented many automata and some of the first mechanical clocks, driven by water and weights. He was called Al-Jazari after the area where he was born, Al-Jazira, which is the traditional Arabic name for northern Mesopotamia. Al-Jazari draws on the works of its predecessors both from the Greeks (Philon, Heron and Archimede) and Islamic world (Banu Musa brothers, Al-Khuwarizmi and Ridwan). His contribution was very important for the diffusion of knowledge in the Arabic world and after in Europe due to the translations of his books like "The Book of Knowledge of Ingenious Mechanical Devices" which contains more than 150 automata and mechanical devices. I take the picture in the museum showing a page of "A Compendium on the Theory and Practice of the Mechanical Arts" dated 1315-1316 (AD). The picture shows the internal structure of an automata for serving and arbitrating drinking sessions. That is to say that Al-jazira has an important place in the history of artificial creatures.Saturday, March 11, 2006

Digital Life and Evolution

In the famous Science-Fiction Hyperion book series written by Dan Simmons, the evolution of small virus programs in the Internet leads to the Infosphere. The story begins with Tom Ray’s Tierra project and ends with Artificial Intelligences, cybrids, and other virtual creatures. Is that possible ?

In the famous Science-Fiction Hyperion book series written by Dan Simmons, the evolution of small virus programs in the Internet leads to the Infosphere. The story begins with Tom Ray’s Tierra project and ends with Artificial Intelligences, cybrids, and other virtual creatures. Is that possible ?There is a long story of virtual ecosystems research projects : Tierra, Avida, LifeDrop and many others (left image shows a typical LifeDrop run - you can experiment it by following the LifeDrop link on the right). All these programs are based on the evolution of digital organisms by means of “digital DNA” mutations and cross-overs. Another characteristic is that these programs use a virtual machine layer between the computer operating system and the creatures. This virtual machine creates a more suitable environment for bio-inspired digital creatures and it represents also a sort of protection barrier between the system and the outside computer world. After more than a decade of research, some digital organisms are getting closer to fulfilling the definition of biological life : most of the features that biologists have said were necessary for life we can check off. These experiments raise multiple questions: What is the definition of life ? Are some of these digital creatures really alive ? Is the evolution in such systems really open-ended ? Is it possible to create digital organisms directly in the computer memory without any ecosystem simulation ? Well, I’ll try to address some of these important questions in future posts… Keep tuned.

Friday, March 03, 2006

Modeling Stock Markets with Cellular Automata

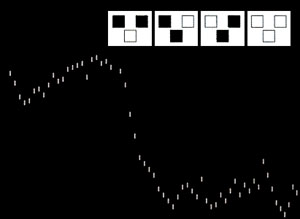

In the recent years, there has been an increasing interest in simulating financial systems using multi-agent models and Cellular Automata (CA). There is a strong feeling that financial markets are typical complex systems in which the global dynamical properties mainly depend on the evolution of a large number of non-linear interacting agents. An extreme view of this is to consider that much of the randomness of financial markets is the consequence of their dynamics and has little to do with the nature or value what is being trade. This is in contrast with classical models that assume that investors are rational and consider the price a random walk. In his book "A New Kind of Science", Stephen Wolfram has proposed a very simple and idealized model of a stock market. It is a one-dimensional CA where each cell corresponds to an entity that either buys or sells on each step. The behavior of a given cell is determined by the one of its two neighbors at the preceding step (see diagrams (C) S. Wolfram). The application on this rule results in a sort of random behavior that look likes those seen on stock markets curves.

In the recent years, there has been an increasing interest in simulating financial systems using multi-agent models and Cellular Automata (CA). There is a strong feeling that financial markets are typical complex systems in which the global dynamical properties mainly depend on the evolution of a large number of non-linear interacting agents. An extreme view of this is to consider that much of the randomness of financial markets is the consequence of their dynamics and has little to do with the nature or value what is being trade. This is in contrast with classical models that assume that investors are rational and consider the price a random walk. In his book "A New Kind of Science", Stephen Wolfram has proposed a very simple and idealized model of a stock market. It is a one-dimensional CA where each cell corresponds to an entity that either buys or sells on each step. The behavior of a given cell is determined by the one of its two neighbors at the preceding step (see diagrams (C) S. Wolfram). The application on this rule results in a sort of random behavior that look likes those seen on stock markets curves.

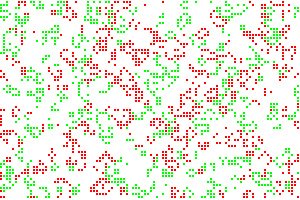

This is true but the problem is that this model is so simple, not to say trivial, that we can use it to model almost everything. Well, I am probably too severe here, but we need a more realistic CA model to work on financial markets.  I have tried to use a two-dimensional CA with three states: sell, keep or buy, and a more realistic transition rule. However, at this time, results are not very convincing from my point of view. The colored picture is a small part of a bigger image showing a typical run. One important feature of this model is the deterministic nature of its transition rule that contrast with most other studied stock market CA models. So, I hope to find something interesting the near future.

I have tried to use a two-dimensional CA with three states: sell, keep or buy, and a more realistic transition rule. However, at this time, results are not very convincing from my point of view. The colored picture is a small part of a bigger image showing a typical run. One important feature of this model is the deterministic nature of its transition rule that contrast with most other studied stock market CA models. So, I hope to find something interesting the near future.

Subscribe to:

Comments (Atom)